What is MSME? Full Form, Meaning & Benefits Explained

The economy of India depends much on the growth of small-scale industries because of the diversification which they afford. These enterprises are recognized legally under MSME, which is Micro Small, and Medium Enterprises. Known in the global market as promising engines for creating innovations, jobs, and overall economic growth, MSMEs serve important purposes in both developed and developing areas.

The Government of India has paid more attention to developing the MSME industries by providing various incentives like subsidies, financial support, and credit facilities. In this article, you will learn about the complete form and significance of the abbreviation MSME, as well as its classification and the main advantages, without which it is impossible to imagine the successful development of the entire country.

Importance of MSMEs in Inclusive Growth

MSMEs provide strength to different sectors in society and even more to marginalized communities, women entrepreneurs, and rural artisans. They generate economic prospects in the far-off regions and the semi-urban locations rather than the massive cities. This will facilitate the balanced growth of regions and lower the migration pressures in the cities. The fact that MSMEs provide a relatively easy entry point into the formal business ecosystem to first-generation entrepreneurs is another aspect of MSMEs.

Way Forward for MSMEs in India

To maintain momentum, India needs to focus on:

- Improving access to credit through fintech platforms and digital lending.

- Simplifying compliance procedures using AI-powered regulatory tech.

- Strengthening public-private partnerships for training and upskilling.

- Enhancing cluster-based development to create regional production hubs.

What is MSME?

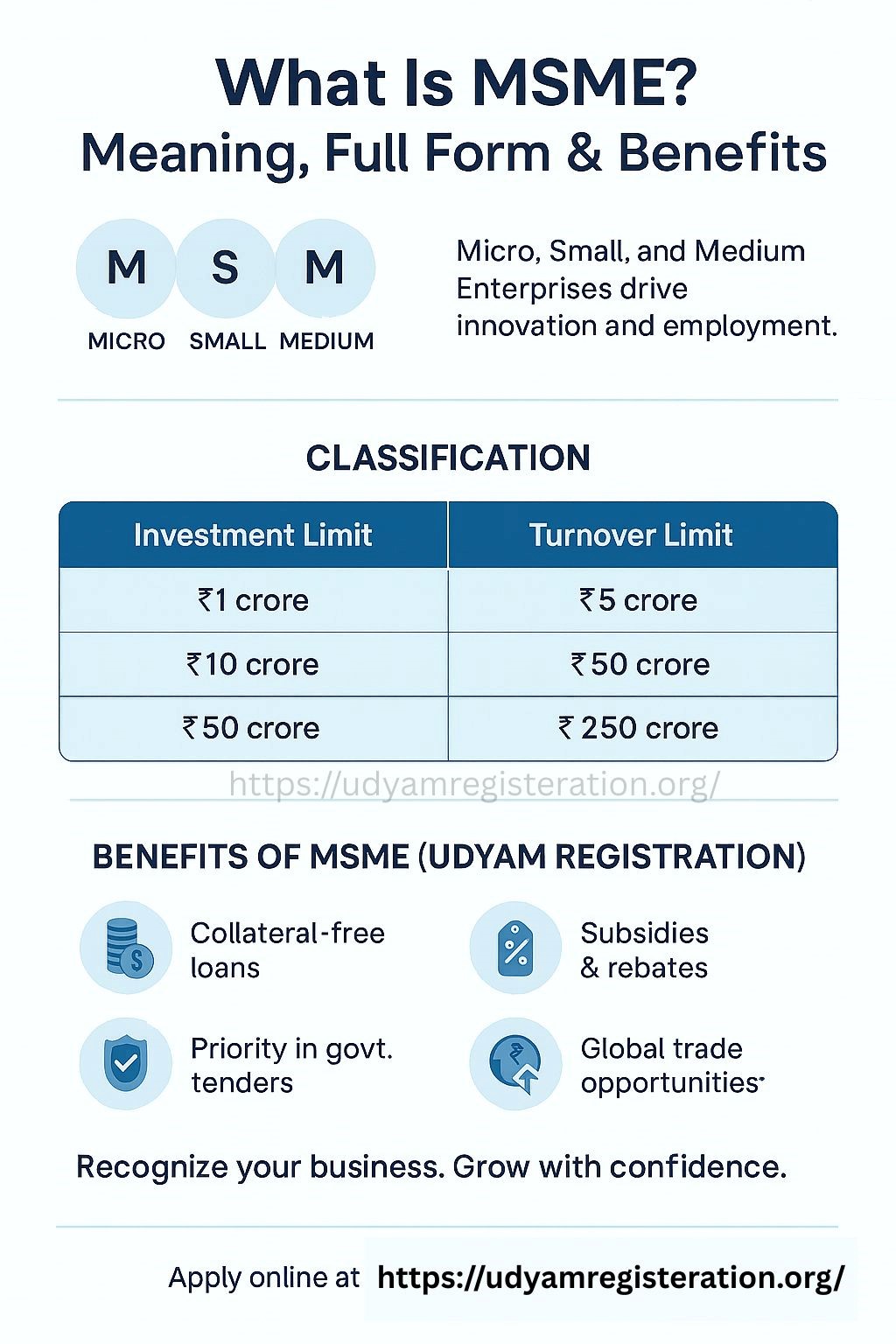

The MSME, which is the short form for Micro, Small, and Medium Enterprises, is a classification of organizations according to the amount of investment that an organization has made in its machinery or equipment and the annual sales revenue. These classifications are intended to increase the efficiency of support and guarantee that businesses receive funds to match the size of their companies.

The MSMEs fall under the Ministry of Micro, Small, and Medium Enterprises Act, as defined under the MSME Development Act 2006, where there is clear discretion made for defining the characteristics between enterprises of this sector

MSME Categories

The criteria for identifying MSMEs were changed in 2020 by adding an investment and sales ceiling, which has made it more responsive and flexible. Here are the details:

| Enterprise Type | Investment Limit | Annual Turnover Limit |

|---|---|---|

| Micro Enterprise | Up to ₹1 crore | Up to ₹5 crore |

| Small Enterprise | Up to ₹10 crore | Up to ₹50 crore |

| Medium Enterprise | Up to ₹50 crore | Up to ₹250 crore |

This dual criterion ensures that enterprises are fairly classified and eligible for relevant benefits.

Meaning of MSME

The term MSME includes manufacturing and service industries, new businesses, and even small shops. These businesses in unison advance innovation, generate employment, and prop up the GDP.

The Micro is characterized by people who run very small businesses or are involved in craftwork with little or no capital investment. The Small and Medium segments are similar to the larger operations but are compulsory integrants of the local and global supply chains.

Suggested Read - Update Udyam Certificate

Role of MSMEs in India’s Economy

MSMEs contribute significantly to India’s economic landscape:

Employment Generation

MSMEs are the second largest employment generator in India next to the agricultural sector; employment generators are being created across different fields.

Export Contributions

The self uses data to establish that MSMEs contribute approximately 45 percent to India’s total exports proving their international significance.

GDP Growth

The MSMEs themselves account for 30% of the contribution towards the GDP of the country and are vital for sustainable economic growth.

Innovation and Entrepreneurship

They promote new ideas and development of small businesses since most of them develop products and services that can cause changes in the market.

Benefits of MSME Registration

MSMEs that register under the Udyam system unlock a plethora of benefits designed to empower and support their growth. Here’s a closer look:

1. Financial Assistance and Credit Support

It receives collateral-free loans under government-sponsored schemes like the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). It also suggests that they have lower interest rates on loans than those of comparable firms.

2. Tax and Subsidy Benefits

MSMEs get relief from the exemption in direct taxes, and subsidies on patents, ISO certification, electricity etc.

3. Priority in Government Tenders

To ensure fair competition in the provision of services, many governmental organizations or departments set aside a certain percentage of tenders specifically for MSMEs.

4. Protection Against Delayed Payments

There are provisions as per the MSME Development Act, 2006 where registered MSMEs are legally allowed to recover the payment within a stipulated period along with interest thereupon.

5. Access to Market Development Assistance

Promoting the products of MSMEs, particularly at international trade fairs and exhibitions, the government offers financial assistance to firms that need it to participate in these events.

Challenges Faced by MSMEs

Despite their critical role, MSMEs face several challenges that hinder their growth:

1. Limited Access to Credit

A large number of MSMEs face difficulties in accessing credit products mainly because of such factors as lack of collateral, and cumbersome procedures in accessing credit.

2. Inadequate Infrastructure

Lack of access to structural facilities in the rural and semi-urban regions hampers the functioning of the MSMEs.

3. Compliance and Regulatory Barriers

Small business owners experience a lot of difficulty in dealing with multiple regulations.

4. Technology and Skill Gaps

Technology underdevelopment and scarcity of skilled human resources hamper innovation and competitive advantage.

Also Read - Benefits of Udyam Registration

Government Initiatives to Support MSMEs

To address these challenges, the government has introduced numerous schemes and initiatives:

1. Make in India

This single largest program has been launched with the objective of incentivizing manufacturing in India and attracting foreign investments for MSMEs in various sectors.

2. Digital India

Through this program, the utilization of digital tools in operations is enhanced hence widening the market for the MSMEs.

3. Pradhan Mantri Rojgar Yojana (PMEGP)

This scheme helps to fund the establishment of new firms with the aim of creating new employment in rural as well as urban sectors.

4. Zero Defect Zero Effect (ZED) Scheme

ZED urges the MSMEs to embrace certifications of quality to warrant their products meet international quality while at the same time reducing harm in the environment.

5. Skill India

This program aims to build human capital in MSMEs the impetus to improve efficiency and invention.

MSME Benefits for Startups

Startups under the Micro, Small, and Medium Enterprises (MSME) category enjoy a wide range of benefits that can significantly boost their growth and sustainability. MSME registration, when combined with startup recognition, provides a powerful edge in today’s competitive market.

The main advantages are:

Availability of Startup India Scheme: Startups registered with MSME have the advantage of availing government-based incubator centers, seed funding and a mentorship program to entrepreneurs so as to build, scale and sustain the business.

Quicker Patents: Startups enjoy the subsidized fee to apply for a patent, and the patent application as well as trademark procedures, are completed quicker via fast-track programs.

Ease of doing Business: MSMEs get ease in compliance norms, self-certification, and inspection, which comes as a reduction in the cost of doing business and having more time to concentrate on business growth.

Collateral-Free Financing: MSMEs are allowed to avail priority sector lending and government-backed credit guarantee arrangements to lower the business risk of collateral arrangements of conventional nature.

Tax benefits and Exemptions: MSMEs offering tax exemptions to the eligible startups can get up to 3 years of income tax exemptions and GST rebate

How to Register as an MSME

Step 1: Visit the Udyam Registration Portal

- Go to the official Udyam Registration website.

Step 2: Fill in Business Details

- Provide essential details, including PAN, Aadhaar, business type, and contact information.

Step 3: Verify and Submit

- Complete the verification process and submit your application. You will receive a unique Udyam Registration Number (URN) upon approval.

FAQs

What is the difference between MSME and SME?

- SME is a broader term used globally, while MSME is specific to India and includes micro enterprises in its classification.

Is MSME registration free?

- Yes, registering under the Udyam system is free of cost.

Can a service-based business qualify as an MSME?

- Absolutely. Both manufacturing and service-based businesses can register as MSMEs.

How often should MSME details be updated?

- Businesses should update their MSME details whenever there are significant changes, such as in turnover or investment.

Are self-employed individuals eligible for MSME benefits?

- Yes, self-employed individuals running eligible businesses can register under MSME and avail of benefits.

Future Outlook for MSMEs in India

Digitalization, policy changes, and global supply chain entries will play revolutionary roles in the future of Micro, Small, and Medium Enterprises (MSMEs) in India. Today, there are over 63 million MSMEs in the nation; however, it is anticipated that with India on the track to becoming a $5 trillion economy, their significance will be even strongly felt.

One of the strongest growth factors is the introduction of digital technologies. It could be in terms of the e-commerce platform innovation or the operations utilized with the help of AI, but MSMEs are also turning to technology-based solutions readily to allow processes to become smoother, cover more customers, and support operational expenses. The government initiatives like the Digital MSME or partnerships between the government and large technology companies, are also driving this change.

The other possible sphere is integration into the global market. Indian MSMEs can access the foreign markets in an improved way due to the rise of Free Trade Agreements(FTAs). The MSMEs are also expanding in terms of exportation as being involved in online related to exportation aside from participating or being involved in the trade fair arena and the incentives that are presented under various governments' agendas, such as the Champion Services Sector Scheme (CSSS).

The next decade is also going to be marked by the emergence of green and sustainable MSMEs. The government-sponsored ZED (Zero Defect Zero effect) program has stimulated the uptake of environmentally based manufacturing processes and goods and services that are environmentally friendly are growing in demand both in the local and the international market.

FAQs

What are the differences between MSME and SME?

The term SME is more universal, globally, whereas the term MSME is Indian specific and they consist of micro enterprises as well.

Is registration of MSMEs free?

Yes, the cost of registration under the Udyam system is nil.

Is it possible to have a service-based business to be an MSME?

Absolutely. Manufacturing and service-oriented businesses can become members of the MSMEs.

Should the MSME details be updated how frequently?

Whenever a notable change happens that should be a change in turnover or investment or anything related to MSME, businesses should update their MSME details.

Can we get the benefits of MSME by being self-employed?

Yes, a self-employed person can have her or his business registered under the MSME and enjoy such benefits by operating an eligible business.

Conclusion

MSMEs have always been the backbone of the Indian economy, and this includes the creation of employment, innovation, and the growth of the economy. This is critical in a bid to embrace the support offered to entrepreneurs by the government through entrepreneurial financing and capital or through loan schemes.

You can set your business to be successful over the long term by registering your business as an MSME and taking advantage of the benefits. The first step is to take action today and look at the potential that the MSME structure brings.

Apply For UDYAM Registration

Apply For UDYAM Registration